Insolver solves problems

- Price formation

- Customer scoring

- LTV estimate

- Loss control

- Outflow management

- Fraud control

- Cross-selling

- Call center optimization

Insolver

solves problems

solves problems

Our development products and services

About us

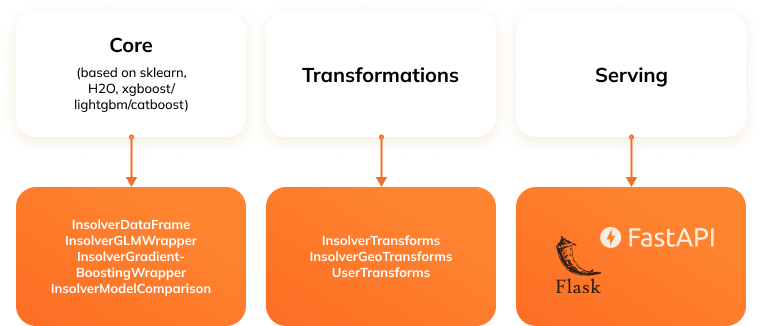

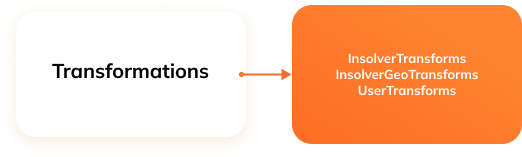

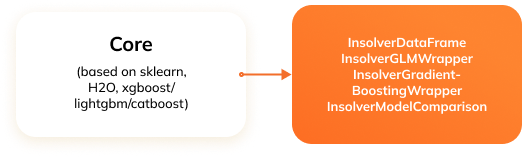

- Using Open Source Frameworks

- Create flexible modules for different tasks

- We develop both complex models for the best forecasts and light models for the fastest possible counting.

A wide range of models

Artificial intelligence,

It's not a black box.

We help look into the depths of AI insurance models.

It's not a black box.

We help look into the depths of AI insurance models.

Easy-to-understand analytics

Our solutions work.

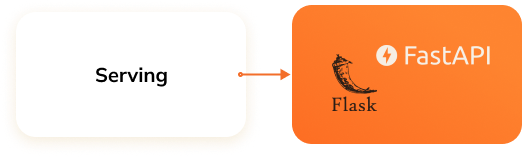

Models can be deployed in a few simple steps in the company's infrastructure or in the cloud.

Models can be deployed in a few simple steps in the company's infrastructure or in the cloud.

Single сlick production

Years of work.

Dozens implemented models.

Dozens implemented models.

Experience in insurance for more than 10 years

Our secure environment allows us to work in the powerful cloud mset.space and do research and deploy models in minutes.

For each analyst

Allow to work with notebooks as papelines

Web User Interface

Exploring the world to make it better

Technology

Our affairs

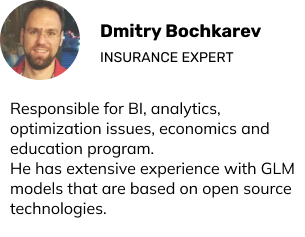

Our team

We are constantly updating the status of the models and making them available to the insurance industry.

What's new with us?

Sharing on Telegram

Sharing on Telegram

About development

Insolver is developed and maintained by insurance and development professionals.

Here are some of them.

Here are some of them.